The economy is everywhere that life is not: but however intertwined the two may become, they simply do not meld, and one can never be confused with the other.

Raoul Vaneigem, The Movement of the Free Spirit (1994)

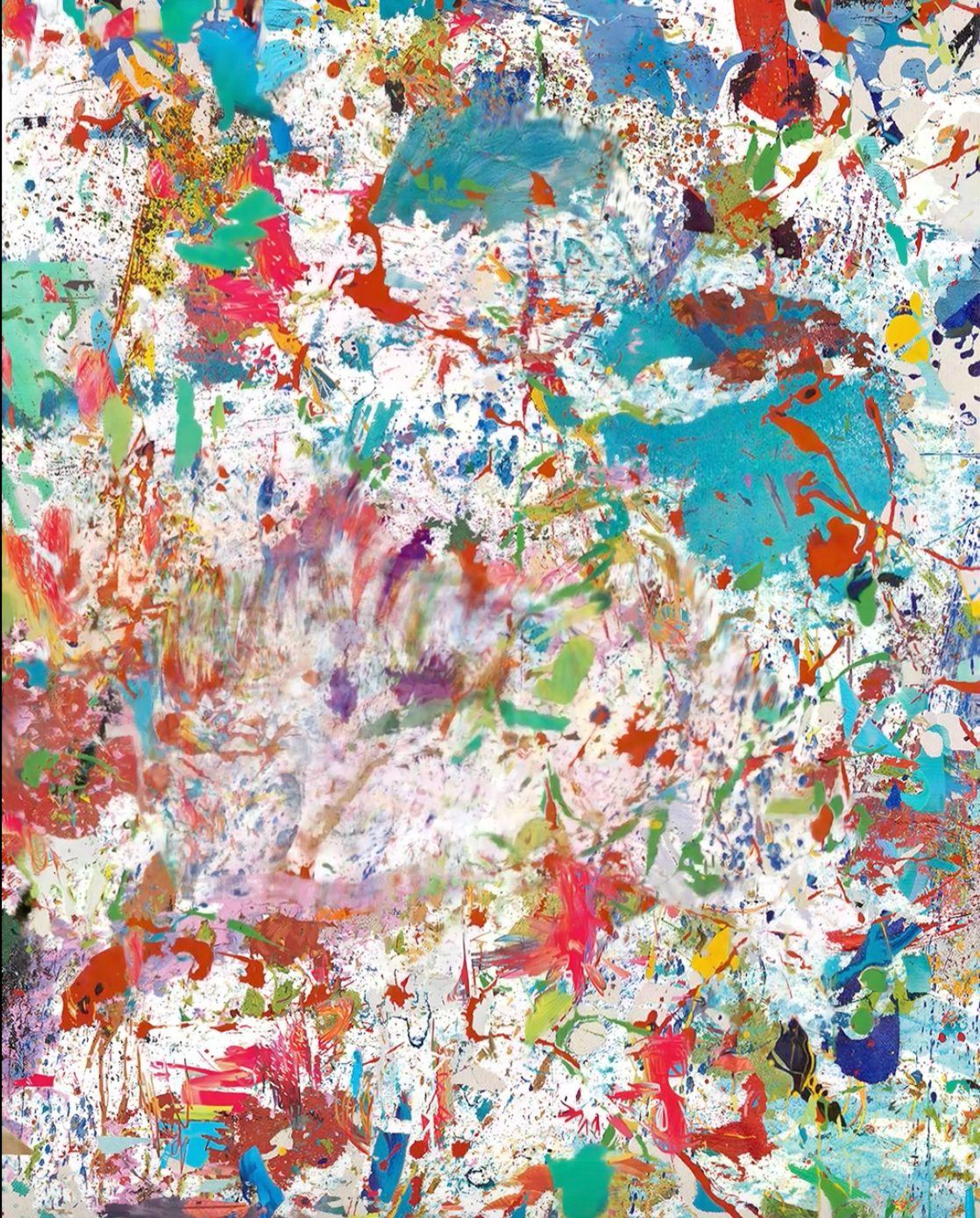

I’m thinking about the epochal changes that have rocked the past year as I take in the busy, vibrant homepage of the NFT platform Foundation . At the top of the page, there is a snippet on the auction that has just finished, and below that, the current bids in progress, the figures updating feverishly. The work Boxer by American artist Austin Lee has just gone to @hypnopizza, for the considerable sum of 17.05 ETH (over $37,000 at the time of this writing, April 2021). The artist will continue to earn a percentage on future transactions, which is not the norm in the secondary art market, where artists typically only get a variable percentage (usually 50%) of the first gallery sale. Boxer had been listed a couple of days earlier for a modest $4,000. I followed the auction as a spectator, and I can only imagine the artist’s elation when @RultonFyder offered to throw down 10 ETH, and during the final hour, when the bids came flooding in thick and fast. I have no idea what financial impact this sale will have on Austin Lee, an American artist (*1983) based in New York who has been getting popular for his maximalist, multicolour airbrush paintings, midway between art brut and a child’s drawings, packed with “analog” references to digital effects and aesthetics. Considering the opening price, I’m guessing that 17.05 ETH is a windfall far beyond what he expected for this looping animation, executed in his signature style, depicting a winning boxer doing a little victory dance in the ring.

This is how Foundation works: artists list NFTs for sale at a reserve price, and once the first bid is placed, a 24-hour auction countdown begins, at the end of which the work goes to the highest bidder. It’s hard to find out much about the collector who scored Boxer : at present, on Foundation, @hypnopizza has only collected two works. There are two social media accounts listed on their profile: an empty Instagram account and a Twitter opened in April 2021 for the express purpose of tweeting about their purchases.

Interviewed by Hyperallergic in a podcast in March 2021, Lindsay Howard, Foundation’s Head of Community, reported that in the platform’s first three weeks, 27 artists earned more than $10,000 from the sale of NFTs, 150 earned more than $1,500 and 215 earned more than $800. Given the situation right now, it’s pretty remarkable – things are fairly dire, and the art world is desperately seeking solutions. It’s hard to know where to look for a helping hand, but it’s quite easy to imagine that with art now increasingly experienced (and marketed) online, the internet could hold the answers. Could the NFT market be the solution, or at least a solution?

Francoise Gamma, Fractura (2021). Still from animated gif

Maybe not so fast. Way back in 2017, Australian journalist David Gerard published Attack of the 50 Foot Blockchain: Bitcoin, Blockchain, Ethereum & Smart Contracts , and since then has followed the development of all things blockchain on his blog. In Gerard’s view, cryptocurrencies are not a technological issue but a psychological one; seemingly wonderful technologies that fail to work in practice. In a blog post in March of 2021, he felt compelled to warn artists that NFTs are a scam, carried out with two aims: to promote cryptocurrencies and bring more money onto the blockchain. According to Gerard:

“The purpose of NFTs is to get you to give your money to crypto grifters. When the grifter has your money, the NFT has done its job, and none of the fabulous claims about NFTs need to work or be true past that point. NFTs are entirely for the benefit of the crypto grifters. The only purpose the artists serve is as aspiring suckers to pump the concept of crypto – and, of course, to buy cryptocurrency to pay for ‘minting’ NFTs. Sometimes the artist gets some crumbs to keep them pumping the concept of crypto.”

Gerard’s arguments revolve around two main points. The first, which we will return to shortly, is that an NFT does not authenticate anything, and does not make anything rare. Essentially, it’s just a pointer, a link to a resource that continues to be reproducible because (in most cases) the artwork itself does not reside on the blockchain. There is no such thing as digital ownership: the only thing that someone who registers or buys an NFT owns is the token itself, which merely represents the work of art.

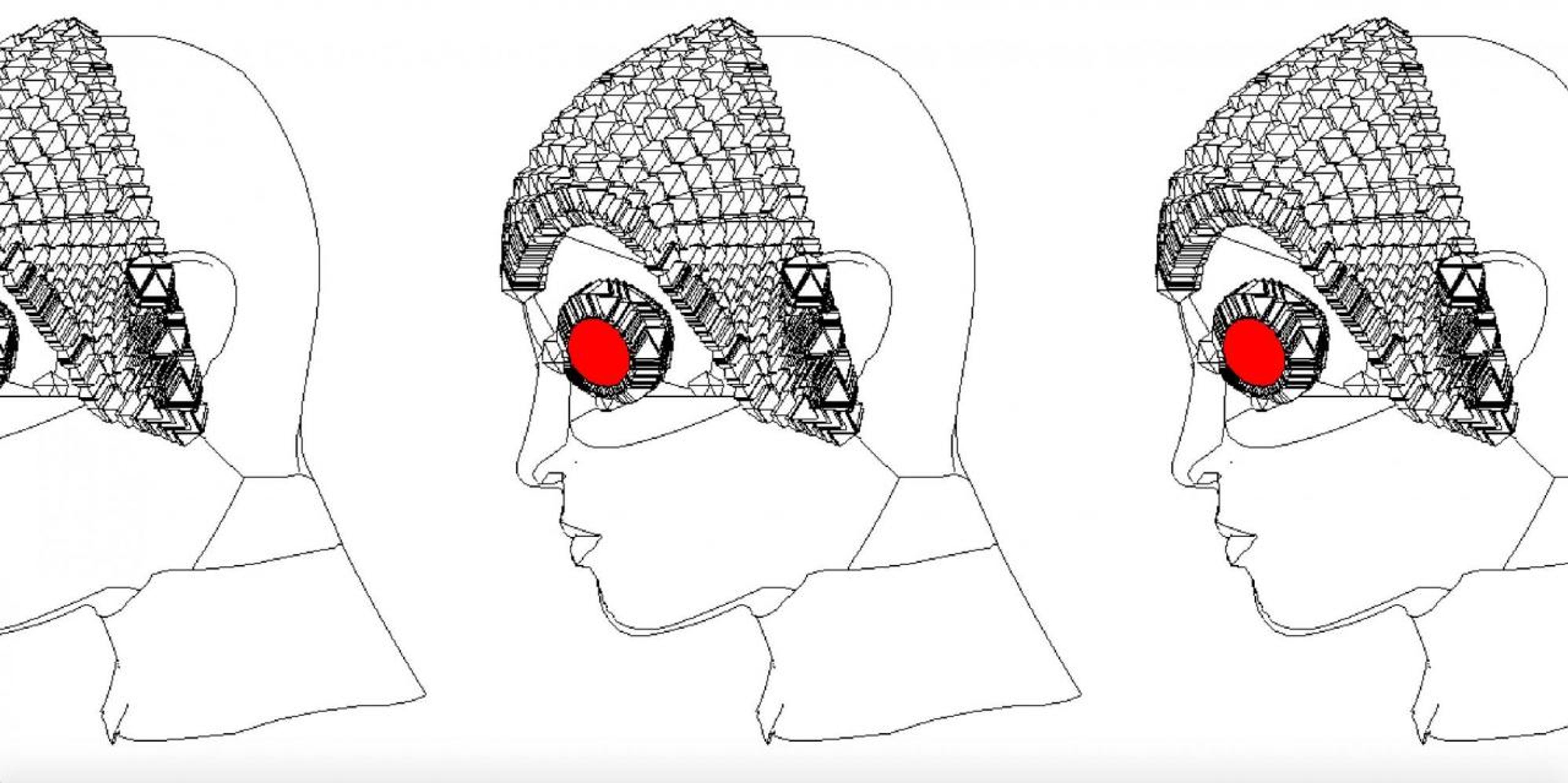

Theodoros Giannakis, Daemon (cene) (2021). Video still

The second point is that art basically plays PR for cryptocurrencies, lending them credibility and tangibility. Gerard is not alone in thinking this. Damien Hirst – who, it is worth remembering, lent his name and his work to promote the launch of Palm, a new and more ecologically-sustainable blockchain – explains that works of art serve the same function for fiat currency: making us believe in the value of money. Surprisingly, Seth Price is on the same wavelength: art is used, he tells former Artforum EIC Michelle Kuo, because “it, itself, is a good tool to further the larger project, which is developing these new forms of trading, speculation, circulation. Art is just a useful idiot in this scenario.” Critic Brian Droitcour concurs :

“You can see the NFT as an expanded form of art that manifests concepts of value, ownership, and networked community. Or you can see it as an assertion of crypto’s worth, a financial asset valuable because of its uniqueness – a property it signals with a façade of art … They make the investments needed to grow the blockchain feel visible and tangible.”

the problem is that the technology leaves us no choice: either we trust them, or we don’t enter their market.

Even Foundation’s own Lindsay Howard gestures in this direction when she explains, in the aforementioned podcast interview, that before NFTs, cryptocurrency could only be used to buy other cryptocurrency. The arrival of art on the blockchain makes the “crypto-rich” feel socially useful for supporting a nascent artistic community – and somehow renders their wealth more real, more concrete. More importantly, big NFT collectors like Anand Venkateswaran , the co-founder of investment fund Metapurse, openly declare that, by infusing real value into the blockchains, they can solve endemic problems plaguing decentralised finance such as volatility and governance issues. Colborn Bell, who founded the Museum of Crypto Art, chimes in that “crypto art is the visual language for the crypto financial revolution,” aiming to “spread cryptocurrency mass adoption, which I think will create a fair economic system for everybody”.

Can we take these claims of enriching “everybody” at their word? According to the Canadian concept artist and illustrator Kimberly Parker, there is no doubt: the artists are the losers – victims of a Ponzi scheme in which they, the newest arrivals, pay out to the first investors, who sit back and rake in vast sums. Parker backs up her claim with a deep-dive into sales data over a single week, extrapolating a series of graphs that show the actual figures, rather than just averages (which can prove misleading). The results are telling: two-thirds of the NFTs sold were only sold once; out of the sales recorded on the primary market, almost sixty-five percent sold for less than 300 bucks – with a third commanding less than $100. Taking “gas fees” (the notoriously high costs incurred by transacting on the Ethereum blockchain) into account, it is highly likely that an artist who sells a work for less than $100 will get precisely nothing – or less than nothing – in terms of financial return. NFT marketplaces, Parker concludes, are “victim factories”, and it is not just naive tech investors getting washed for capital that are the victims – it is, perhaps much more disturbingly, the artists themselves.

Anna Carreras, Ganxillo (2021). Screenshot of generative interactive software artwork made using Javascript (p5.js), HTML, CSS

This is all the more alarming in light of the fact that digital property “ownership”, in this nascent world of NFTs, is essentially – much like how sci-fi soothsayer William Gibson first characterised cyberspace – a consensual hallucination. Ever the sceptic, David Gerard analysed the 33-page contract accompanying the highly-publicised Christie’s sale of Everydays – Beeple’s monumental digital mosaic which commanded the incredible sum of $69 million last year – and found that there is not a single line that says that its buyer, the pseudonymous investor Metakovan, has become the owner of anything more than the particular ERC-721 token associated with the work. It is the Gordian knot of NFTs: you register a cryptographic token on the blockchain and that token is unique; but if the asset associated with it is a digital good, it’s not totally truthful to call that good “unique” – because it is and remains infinitely reproducible. As for the digital file’s authenticity: if it is not accompanied by another form of certification, all we can do is trust in the good faith of the person who registered the associated token.

To some extent, these problems can be rectified. The great thing about smart contracts is that they are programmable; once they are written, their terms and conditions are permanently embedded in the NFT’s code. Several blockchain-based art spaces are working on developing smart contracts that incorporate clauses on authenticity and the management of artists’ rights, so these provisions can be addressed on the blockchain. Encoding the artwork itself – instead of the token associated with it – directly “on-chain” is also technically possible, at least for small files. (It’s often prohibitively expensive, although this problem might be solved in the long run.)

Kamilia Kard, A Rose by Any Other Name (2021). Screenshot of animated 3D model

For now, though, the buyer of an NFT must accept that they are only purchasing a certificate of ownership which is basically a lie – asserting that the associated file is unique when it is anything but. And for all the talk of decentralisation and disintermediation, we are placing our trust in two “third parties”, namely the seller and the platform. As we evaluate our faith in platforms: the question is not so much whether the owners of the major NFT marketplaces are enlightened patrons only interested in helping artists, or, like the Winklevoss twins – co-founders of Facebook and now the owners of Nifty Gateways – representatives of the rampant, brazen capitalism of Silicon Valley. Rather, the problem is that the technology leaves us no choice: either we trust them, or we don’t enter their market. And as for provenance, we must trust that the person who registered the token is telling the truth about the nature and provenance of the work, in a context where the authenticity of the latter is threatened by theft (the seller might have stolen the work from another creator) and appropriation (the seller might be reusing found material without declaring the source), all beyond the control of a reliable intermediary, such as a gallery or art dealer. Thanks to the much-vaunted value of decentralisation, scams, mistakes, and slip-ups on the blockchain are forever – for good or ill, no central authority can insure things with their guarantee.

So much for the claim that the blockchain came into being to remove “trust” from the equation. To maintain this “collective hallucination”, we have to believe – with or without proof – that the seller is also the creator or legitimate owner of the work; and we have to believe – with no proof whatsoever – that the platform whose server our intangible asset physically resides on will last forever, or manage to solve the problem of portability in due course. Just how trusting should we be?

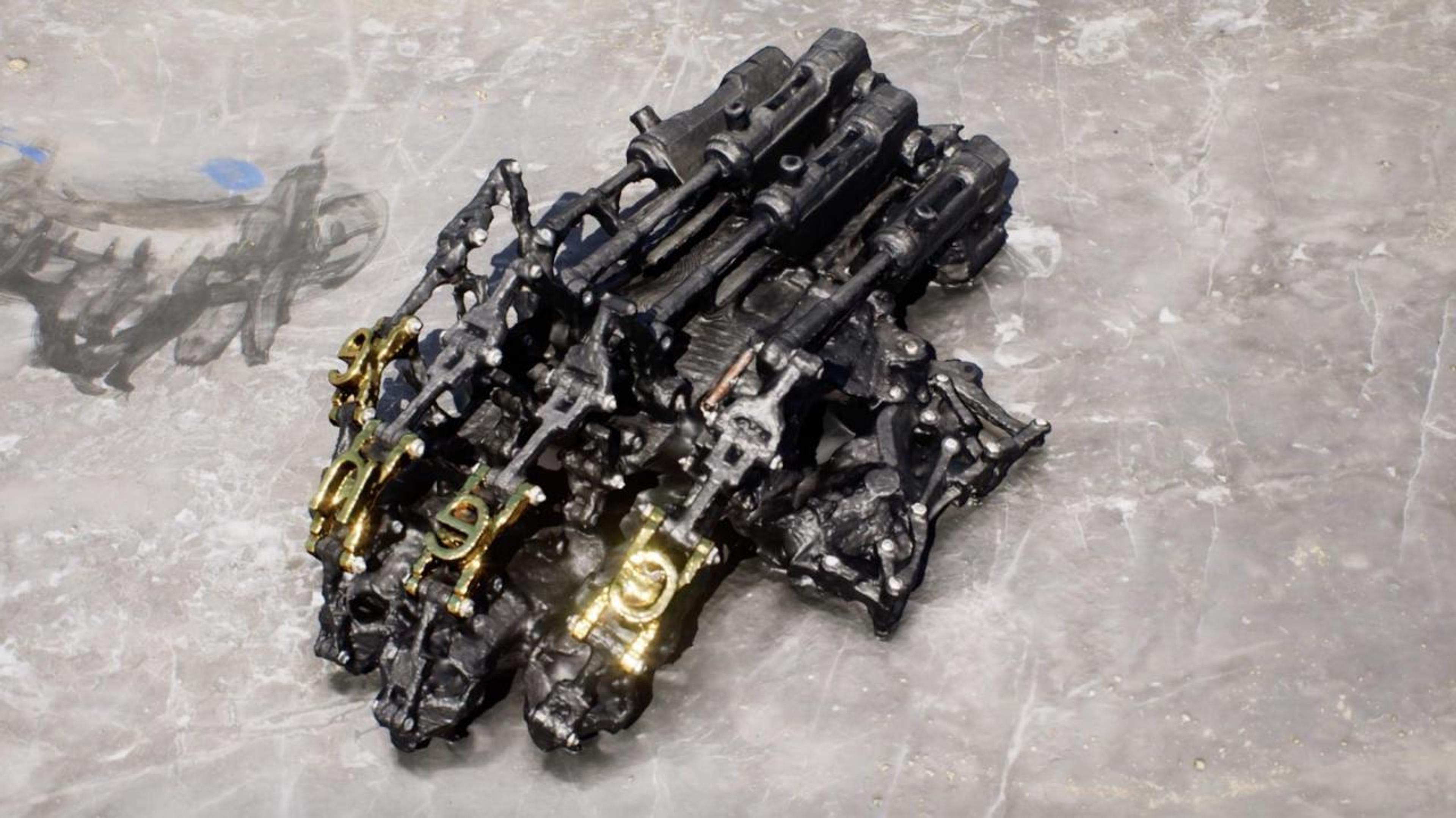

Jonas Lund, Smart Cut (2021). Video still

This text is a translated and edited excerpt from the book Surfing con Satoshi. Arte, blockchain e NFT, published in Italian by Postmedia Books in June 2021. The English translation of the book will be published by Postmedia and Aksioma Institute for Contemporary Art Ljubljana in Spring 2022.

Translated by Anna Rosemary Carruthers.

DOMENICO QUARANTA is a writer, curator and teacher living in Italy.